Canadian Tax Year - Key Dates 2024

Get your key dates for the Canadian tax year in our calendar.

The Canadian tax year runs consecutively with the calendar year.

This means that it starts on the first day of the year, and ends on the last.

Knowing what dates to remember can help you come tax time.

Here are some of the key dates to remember in the Canadian tax year.

Canadian Tax Year - Key Dates 2024

This calendar should help familiarize you with Canada’s key tax deadlines for 2024:

02 January 2024

First day of new tax year.

23 January 2024

E-file service is closed for maintenance.

24 February 2024

E-filing open for resident and immigrants in Canada for 2022 tax year.

28 February 2024

Last day to issue T4s, T4As and T5s to employers and CRA (Canada Revenue Agency).

02 March 2024

Deadline for contributing to an RRSP for the 2023 tax year.

15 March 2024, 15 June 2024, 15 September 2024, 15 December 2024

Instalment payments due dates for 2024.

21 April 2024

Deadline to set up a pre-authorized debit payments for 2021 to avoid interest charges.

1 May 2024

Filing due date for 2023 tax returns for individuals and pay balance due, if any to the CRA.

15 June 2024

Filing due date for 2023 tax returns for self-employed in Canada. In case of balance owing for 2023, it still has to be paid before 30 April 2024.

31 December 2024

Last day of tax year.

Tax Tips for Canada

Moving to Canada or visiting on a working holiday? It pays to know a little about your tax obligations! Here are some quick tips to help you.

1. Resident or Non-Resident

Are you a resident or non-resident? Because this factor will affect what taxes you pay in Canada. Everyone who works in Canada will pay income tax on their earnings but there is a tax-free allowance.

Residents are taxed on their worldwide income and while non-residents must declare all their income, including worldwide, they only pay tax on income earned in Canada.

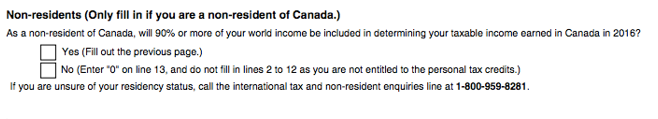

Generally, you will be considered a non-resident for tax purposes if you normally, customarily and routinely reside in another country. You will most likely be considered a resident for tax purposes if Canada is the place where you, in the settled routine of your life, regularly, normally, or customarily live.

You can read more about the criteria here.

The average Canadian tax refund is $998

2. Tax-Free Allowance

The basic personal tax-free allowance was increased to $15,000 in 2023.

However, you may not always be eligible to claim this credit, and that will be decided by a form called a TD1, which you will fill out when you start a job in Canada.

For example, if you worked in another country in the same tax year that you worked in Canada (from Jan-Dec), you should not claim the personal tax credit if the income you earned outside the country was more than 10% of your total income. This is the 90% rule.

So you only claim the tax-free allowance if you earn at least 90% of your total income from that year in Canada.

3. Your TD1

The TD1 is a form you need to fill in when you start or change your job in Canada. You will fill in a TD1 Federal form and TD1 provincial form, depending on where you choose to work. There are a couple of places where you could get tripped up on this form.

The first one is if you worked in another country before you came to Canada. If you earned income from another country in the same tax year you worked in Canada, you need to make sure you earned at least 90% of your income in Canada to avail of the personal tax credits.

If you earned more than 10% of your income outside Canada in that year, then you should enter 0 in box 13 and tick ‘’No’’ on the non-resident question on the TD1 form.

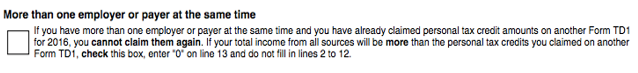

The second area you may get wrong is if you work in more than 1 job at a time. You must make sure you do not claim the personal tax credits twice! If you are eligible to claim the credits, please only claim them for one job. It’s advisable to claim them for the job that pays the most.

If you feel that you have incorrectly claimed tax credits, you can change them at any time. Simply print off and complete new Td1 forms and give them to your employer.

4. Expenses

You may be able to claim for certain expenses, including work-related and medical expenses. Depending on the type of employment, you may be able to claim work expenses.

There are two conditions to qualify:

- Your employment contract requires you to pay the expenses

- You don't receive an allowance to pay the costs or if you do receive an allowance, your employer adds it to your total income

Examples of these types of expenses include: transportation costs, cost of electronic devices, accounting and legal fees, and possible rebate of GST (Goods and Services Tax) or HST (Harmonized Sales Tax) taxes paid when you purchased these items. Any expenses must be directly related to your employment and you must retain records for these including invoices and receipts.

5. Filing your tax return

You should file a tax return before the April 30 deadline after the end of the tax year. You’ll need your social insurance number and T4 or final payslip to file. While the deadline is April 30, you can file your tax return in February after the end of the tax year.

If you want to learn more about how to check your tax refund in Canada or calculate your potential refund, you can also find out if you're due some tax back from Canada by using our online tax calculator.

You may be due an income tax refund if:

- You overpaid income tax

- You overpaid in the Canadian Pension Plan

- You overpaid Employer Insurance

File your Canadian Tax Return easily online

You can also find out if you’re due some tax back from Canada by using our online tax calculator.

Need help with your Canadian tax affairs?

Do not hesitate to contact us at info@taxback.com or visit our Canadian tax website today.

You can calculate your refund with our Free Canadian income tax refund calculator.

Why choose Taxback?

-

We have 25+ years of experience, and last year we submitted more than 322,00 tax returns for our customers all over the world

-

Our tax experts will ensure you avail of every expense and relief you're entitled to

-

We'll transfer your maximum legal Canadian tax back straight to your bank account anywhere in the world

-

It's a convenient online service. We do the work. You get the cash!

-

Got tax questions? Our Live Chat team are on hand 24/7 to answer you