Childcare benefit in Germany -Kindergeld - Everything you need to know

The rules are changing for the German childcare benefit 'Kindergeld'. Here is what you need to know.

When working in Germany you may be entitled to claim a wide range of benefits.

One such type of benefit is 'Kindergeld' or German Childcare Benefit.

Germany's social system is well-known around the world, and Kindergeld, in addition to Elterngeld, provides financial assistance to young families.

We will explain everything you need to know in detail in this guide.

What is Kindergeld in Germany?

In Germany, every parent, regardless of their financial situation is entitled to Kindergeld - which is the universal childcare benefit. Just about any taxpayer living in Germany with children can get the Kindergeld, whether they are employed, self employed or independent.

The Kindergeld is a monthly fixed sum paid by the Family Benefits Office (Familienkasse), which is managed by the German Federal Employment Agency (Arbeitsagentur für Arbeit).

Its purpose is to ensure that every child's basic needs are met. You can get it as a rule until your children turn 18, though it can continue until they are 25 if they are still in school or meet other requirements for an extension.

Adopted and foster children qualify you for the Kindergeld, as do children of your spouse and your grandchildren if they live in your household. Some people living abroad may also be eligible for Kindergeld if they meet certain German unrestricted income tax payment obligations or other requirements. You can find out about the exact requirements from the German authorities.

Even if the child was not with you in Germany you can still be entitled to it.

Claim Your Childcare Benefits

How much is Kindergeld in Germany?

The exact amount of Kindergeld you can receive in 2023 is fixed.

That means that no matter how many children you have, the most you can receive is €250 euros per month per child.

It is either paid in cash or directly into the bank account of the relevant parent each month.

Can foreigners in Germany receive Kindergeld?

Foreigners living in Germany can also apply for Kindergeld (child benefits) as long as they have a valid residency permit. Residents of EU/EEA countries do not need a residence permit to apply for the benefits.

You may be entitled to claim the benefit if:

● You are working in Germany

● You are an EU/EEA citizen

● You have a permanent residence permit

Even if you worked and lived in Germany but your child/children did not, you may still be able to claim the benefit.

Residents of an EU or European Economic Area country, as well as residents in Switzerland, are entitled to claim child benefits in Germany. These individuals will receive the difference between the German childcare benefits and the childcare benefits due in their home country.

Who can receive Kindergeld in Germany?

Every parent, regardless of nationality, is eligible to apply for Kindergeld if they meet the following criteria:

- You are a tax-paying German resident, or you have acquired German citizenship and live in the EU, Switzerland, Lichtenstein, Norway, or Iceland

- You look after your child, and it lives in your household

- Your kid is under the age of 18, or one of the exceptions listed below applies

- Your child is unable to support himself or herself because of a disability that occurred before the age of 25 (no age limit)

- Your child is unemployed and registered with the Employment Agency as a job seeker (until age 21)

- Your child is volunteering, studying, or pursuing a career (until age 25 or the completion of their vocational certificate or first degree)

If a child's parents are divorced and share custody, you must decide who will receive the Kindergeld payment with your ex-partner, as only one person can be the beneficiary.

This benefit is available to any adult who is directly caring for a child and living with that child. This could be:

- Foster parents

- Caregivers or guardians

- Step-parents

- Grandparents

- Parents who have adopted

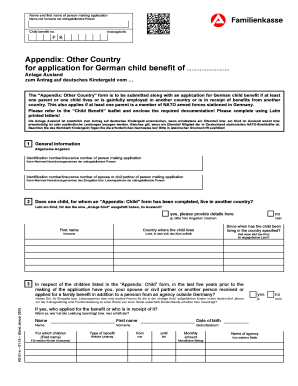

How to apply for Kindergeld in Germany?

You apply for Kindergeld at the Family Benefits Office (Familienkasse) of the local Labor Office (Agentur für Arbeit), with written forms that must be signed. Another party can make the application if you grant them power of attorney.

An easier way of claiming Kindergeld is by doing so directly at Taxback! We have a flat fee and then all you need to do is wait for us to get your money to you!

Please make sure you apply right after starting your employment in Germany because the later you apply, the less money you will get. The new rules will apply to everyone entitled to childcare benefits.

Claim Your Childcare Benefits

How will Kindergeld be paid?

Kindergeld is paid directly into the bank account of one parent (you decide which parent will receive the payment).

The date the money will be transferred to your account depends on your Kindergeld number, which you'll be assigned when your application is processed.

How much time does it take to get Kindergeld?

If you are approved, the child benefit money will be transferred into your bank account on a regular basis. If you are denied, you have one month to file an appeal or submit additional documentation. You will receive a response via postal mail within three weeks to six months of submitting your application.

Kindergeld and Kinderfreibetrag - what’s the difference?

We explained above what is Kindergeld. Kinderfreibetrag is the tax-free allowance for children in Germany. This is €6,024 per child for a married couple in 2023 or €3,012 for a single parent.

When calculating your income tax, the German tax office (Finanzamt) will compare the amount of child benefit you have already received to the amount you could save if you were granted the tax-free child allowance. Furthermore, you should be aware that you receive Kindergeld on a monthly basis, whereas the Kinderfreibetrag is only available once a year when you file your tax return in Germany fo foreigners.

How do you cancel Kindergeld?

If you leave Germany permanently, you must cancel your Kindergeld application. You can do so using the 'Veränderungsmitteilung' form. You must finish the fifth main box, 'Beschäftigung im Ausland.'

Need help?

Contact us at info@taxback.com with your questions or ask a friendly expert in a chat.